Include Social Security Retirement

Include Social Security Retirement

People like you between the ages of 30 and 39 whose annual income is between $40,000 and $79,000 per year, who are on track* for retirement save 10% of their pay.

*'On track' is defined as individuals who fall within the age and annual income ranges shown above who are estimated to have at least 70% of their current annual income available to them starting at their designated retirement age. The estimated income at retirement includes the individual's anticipated annual rate of return and assumes that regular contributions will be made throughout the years leading up to retirement.

If getting a tax-break now is more important (to you):

Employee PreTax

While $188 goes into your account per pay period, only $141 comes out of your take-home pay. This assumes a single filer and 22% marginal tax rate based on the annual salary you provided. For illustrative purposes only. Consult with an appropriate tax and/or legal advisor regarding your situation as your individual rate may vary.

Roth

$0 per pay period

Employee PostTax

$0 per pay period

Closer to retirement and want to save a little more?

Pre-Tax Catch-Up

While $0 goes into your account per pay period, only $0 comes out of your take-home pay. This assumes a single filer and 22% marginal tax rate based on the annual salary you provided. For illustration purposes only. Consult with an appropriate tax and/or legal advisor regarding your situation as your individual rate may very.

Roth Catch-up

$0 per pay period

Our hours are Monday-Friday, 8 A.M. to 9 P.M. ET.

Customer Service Associates are available to help you complete your enrollment. They can help you understand the enrollment process, how your plan works, and what options you have.

Please note, Customer Service Associates are unable to provide investment advice.

Puedes traducir esta página web al español seleccionando “Español” en la parte inferior de la página.

Nuestro horario es de lunes a viernes de 8 a.m. a 9 p.m., hora del este.

Los Representantes de Atención al Cliente están disponibles para ayudarlo a completar su inscripción. Ellos pueden ayudarlo a entender el proceso de inscripción, cómo funciona su plan y qué opciones tiene usted.

Tenga en cuenta, los Representantes de Atención al Cliente no pueden proveer asesoramiento de inversiones.

Please review the following documents prior to enrolling in your retirement plan. They contain important information about your employer-sponsored retirement program and the investment options the plan makes available to you.

You must have Adobe Acrobat Reader installed on your computer/device to view online documents in a PDF format.*

Participant Disclosure Booklet

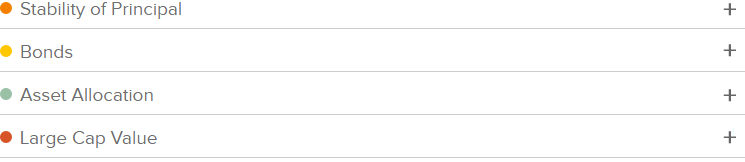

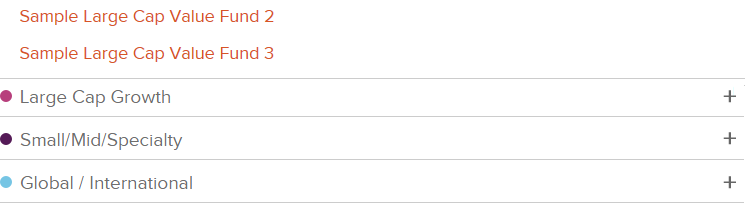

Funds Grouped by Asset Class

Investment Information - Disclosure and Glossary of Terms

Investment Performance Update

Morningstar Agreement, Privacy Notice and Form ADV Part 2A and Part 2B

Morningstar Summary and Fee Disclosure

Participant Fee Disclosure

Qualified Default Investment Alternative Initial Notice

Voya's Excessive Trading Policy

Privacy Notice

* You can receive a paper copy of a document free of charge by calling your retirement plan's toll free phone number and requesting it from the customer contact center, or by submitting a request in writing.

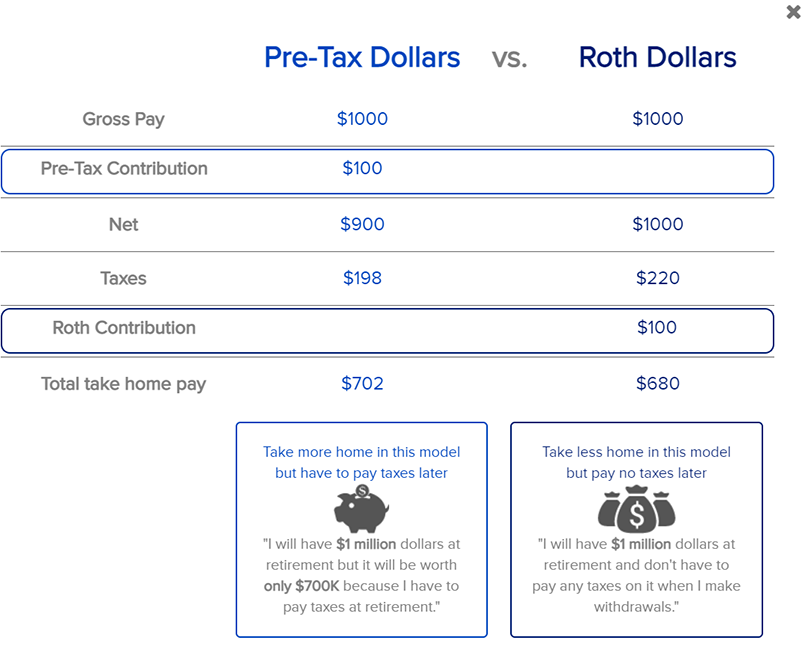

Assumes a 30% marginal tax rate. For illustrative purposes only. Consult with an appropriate tax and/or legal advisor regarding your situation as your individual rate may vary.

To better understand the investment options please carefully review this additional information document about types of investment risks, as well as a glossary of termsand statistics found on the fund fact sheets. The document also provides instructions about how to obtain any underlying fund prospectuses.

Any insurance products, annuities and funding agreements that you may have purchased are sold as securities and are issued by Voya Retirement Insurance and Annuity Company ("VRIAC"). Fixed annuities are issued by VRIAC. VRIAC is solely responsible for meeting its obligations. Plan administrative services provided by VRIAC or Voya Institutional Plan Services, LLC ("VIPS"). Neither VRIAC nor VIPS engage in the sale or solicitation of securities. If custodial or trust agreements are part of this arrangement, they may be provided by Voya Institutional Trust Company. All companies are members of the Voya family of companies. Securities distributed by Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a selling agreement. All products or services may not be available in all states.

©2021 Voya Services Company. All Rights Reserved.