| Name: | Sarah Voya |

| Address: | 50 Orange Way, Windsor, CT 06095 |

| Email: | [email protected] |

| Mobile Phone Number: | (555) 555-1234 |

| Date of Hire: | 01/01/2005 |

A single fund that's professionally managed and aligns with my retirement age of around 65.

Primary Beneficiary

Your Spouse John Voya, born on 09/09/1980, will receive 100% of your benefits.

Please Note: If one or more of your named beneficiaries has a disability or special need and currently receives—or may receive in the future—government benefits, the following helpful information may assist you in understanding how the receipt of beneficiary payments may affect the ability to receive other benefits. This should not stop you from this enrollment process and information will be available after enrollment.

I acknowledge that:

All account information and transactions are subject to terms of my plan. I provide my informed consent to the electronic delivery of Important Information by Voya via this website. I understand that this consent applies to the documents available on this website during the period of my enrollment. I understand that the most recent versions of these documents are available on the website. I will be able to select paperless or mail delivery options and manage my communication preferences on the participant website once I have successfully enrolled.

REQUIRED STATE/PRODUCT SPECIFIC DISCLOSURE APPEARS HERE

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

I understand that by selecting the Enroll Now button, I acknowledge the above statements and affirm that I have reviewed Important Information–including fees, investment options, and investment performance–prior to submitting my enrollment choices.

To better understand the investment options please carefully review this additional information document about types of investment risks, as well as a glossary of terms and statistics found on the fund fact sheets. The document also provides instructions about how to obtain any underlying fund prospectus.

*** Generally speaking, Target Date funds target a certain date range for retirement, or the date the investor plans to start withdrawing money. Investors can select the fund that corresponds to their target date. They are designed to rebalance to a more conservative approach as the date nears. An investment in the Target Date Fund is not guaranteed at any time, including on or after the target date.

Our hours are Monday-Friday, 8 A.M. to 9 P.M. ET.

Customer Service Associates are available to help you complete your enrollment. They can help you understand the enrollment process, how your plan works, and what options you have.

Please note, Customer Service Associates are unable to provide investment advice.

Puedes traducir esta página web al español seleccionando “Español” en la parte inferior de la página.

Nuestro horario es de lunes a viernes de 8 a.m. a 9 p.m., hora del este.

Los Representantes de Atención al Cliente están disponibles para ayudarlo a completar su inscripción. Ellos pueden ayudarlo a entender el proceso de inscripción, cómo funciona su plan y qué opciones tiene usted.

Tenga en cuenta, los Representantes de Atención al Cliente no pueden proveer asesoramiento de inversiones.

Please review the following documents prior to enrolling in your retirement plan. They contain important information about your employer-sponsored retirement program and the investment options the plan makes available to you.

You must have Adobe Acrobat Reader installed on your computer/device to view online documents in a PDF format.*

Participant Disclosure Booklet

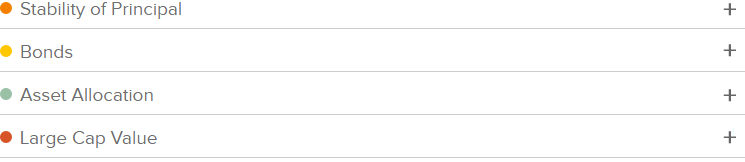

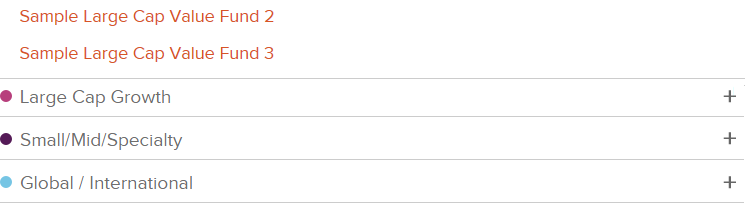

Funds Grouped by Asset Class

Investment Information - Disclosure and Glossary of Terms

Investment Performance Update

Morningstar Agreement, Privacy Notice and Form ADV Part 2A and Part 2B

Morningstar Summary and Fee Disclosure

Participant Fee Disclosure

Qualified Default Investment Alternative Initial Notice

Voya's Excessive Trading Policy

Privacy Notice

* You can receive a paper copy of a document free of charge by calling your retirement plan's toll free phone number and requesting it from the customer contact center, or by submitting a request in writing.

To better understand the investment options please carefully review this additional information document about types of investment risks, as well as a glossary of termsand statistics found on the fund fact sheets. The document also provides instructions about how to obtain any underlying fund prospectuses.

Any insurance products, annuities and funding agreements that you may have purchased are sold as securities and are issued by Voya Retirement Insurance and Annuity Company ("VRIAC"). Fixed annuities are issued by VRIAC. VRIAC is solely responsible for meeting its obligations. Plan administrative services provided by VRIAC or Voya Institutional Plan Services, LLC ("VIPS"). Neither VRIAC nor VIPS engage in the sale or solicitation of securities. If custodial or trust agreements are part of this arrangement, they may be provided by Voya Institutional Trust Company. All companies are members of the Voya family of companies. Securities distributed by Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a selling agreement. All products or services may not be available in all states.

©2021 Voya Services Company. All Rights Reserved.